Fleet

Last updated 2018

The fist price for a Boeing 747 in the beginning had been $25 million, in 2002 it was nearly $200 million, but of course the change in purchasing power parity must not be forgotten. Towards 2012 the list price of the A380 had climbed to $390 million, against $351 million for the smaller B.747-8. Traditional financiers are the banks and aircraft lessors. In 2003 (January) Aerospace America had written that “… requirement for external financing grew to over 50 billion dollar in 2000, up from 7.4 billion in 1996… Boeing looked to manufacturer finance to enhance competitiveness.” The standard way for airlines to spread risk is to lease new aircraft from leasing companies. Towards the end of the century GE Capital Aviation Services (GECAS) of Shannon, Ireland, backed by General Electric, has become the biggest firm in this business with a fleet of more than 1,000 airliners. It had bought the assets of GPA, founded in 1975 by Tony Ryan in Ireland, which had collapsed lacking a big backer. With around 500 aircraft in the year 2000, International Lease Finance Corporation (ILFC) under chairman Steven Udvar-Hazy, affiliated to insurance giant American International Group (AIG), had become number two. Aeroflot leased Boeing planes from Aviakapital Service, a daughter of Rostec. In 2016 GECAS and AerCap were listed as the largest companies, to be followed by Avolon with CIT, amassed by the HNA Group of China. Airlines which cannot afford leasing from the many leasing companies were advised to lease much cheaper from other carriers or to buy second-hand, e.g. a 737 for $15 million (Simon Calder: No Frills). Airliners’ basic lifetime is estimated at 20 or even 25 years on condition that there is an adequate maintenance. Carriers in financial difficulties sold their aircraft and leased them back. By flying wet-leased aircraft under the operating certificate belonging to another carrier, more and more “airlines” have become mere ticket-sellers. Another way to save cost is outsourcing of things like catering or maintenance. MRO – maintenance, repair and overhaul – has become an industry of its own, spread global. Famous airlines’ MROs, such as Lufthansa Technik, offered high-quality services. But also another sort of MRO did spread. “Until not so long every US carrier employed its own highly skilled mechanics, who sported their own FAA licenses, and paid them over $60 per hour. In comparison, mechanics working for outsourcers earn between $10 and $20 and do not have to be licensed, wrote the Athens News (August19, 2005) after the fatal Helios crash.

From 1948, during the pure prop age, a total number of 3,646 aircraft of airlines was reported (by Knaurs Lexikon). In 1961, ICAO statistics (not covering the USSR and China) listed 5,014 aircraft, of which only 388 were jets. For 2000 (year-end) the Boeing Current Market Outlook numbered a total of 14,548 jet aircraft, 1,193 small and intermediate regionals and 1,742 freighters included. According to Boeing’s Current Market Outlook 2013-2032 (published in 2013), for 2012 a total number of 20,310 and for 2032 a total number of 41,240 jet aircraft was estimated, with a fleet distribution of 14,750 in the Asia-Pacific region, 8,810 in North America, 8,010 in Europe, 3,790 in Latin America, 2,875 in Mideast, 1,530 in CIS countries and 1,500 in Africa.

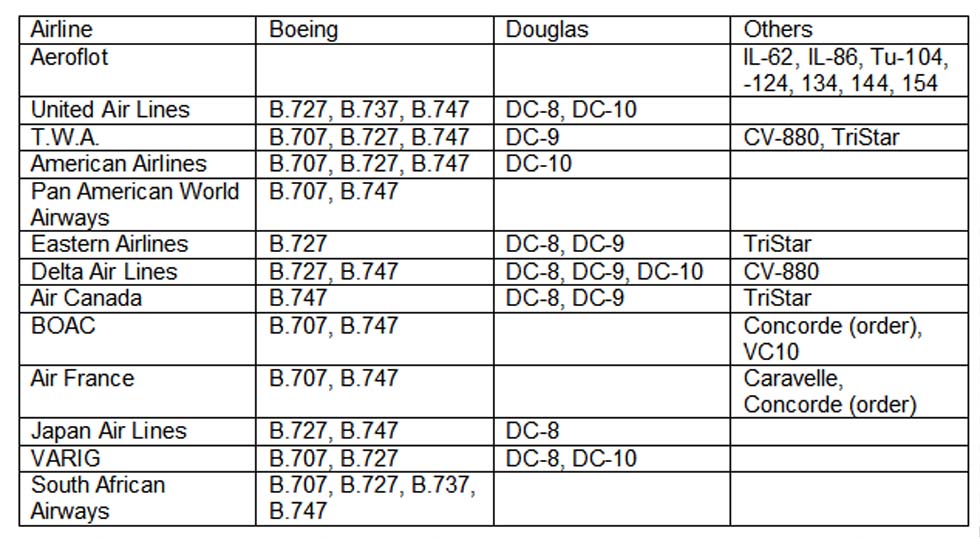

The top-ten and some selected leaders within their region, ranking by RPK in the early 70s, their fleet and orders (except prop, regional and freighters) in 1973:

Note: Airlines are mentioned without their subsidiaries. Generally no differentiation is made between aircraft derivatives. Leased aircraft are included. China’s CAAC had to rely on Soviet-built aircraft, an exception in 1970 being the HS.121 Trident. In 1972 the Boeing 707 was ordered and the copy Y-10 became hidden away.

The top-ten and some selected leaders within their region, ranking by RPK, their fleet and orders (except regional and freighters) in 2000:

Note: A32S means the multitude of A320 derivatives, MD (DC-9) comprises the DC-9 derivatives.

The top 15 airlines ranking by RPK (revenue passenger kilometers) and some selected leaders within their region, their fleet and orders (except regional) in 2015:

Boeing 767, Delta Air Lines, Honolulu 2014 (WS)

Boeing 777, Aeroflot, Munich 2005 (WS)

Airbus A380, Emirates Airline, Munich 2015 (WS)

|